Introduction

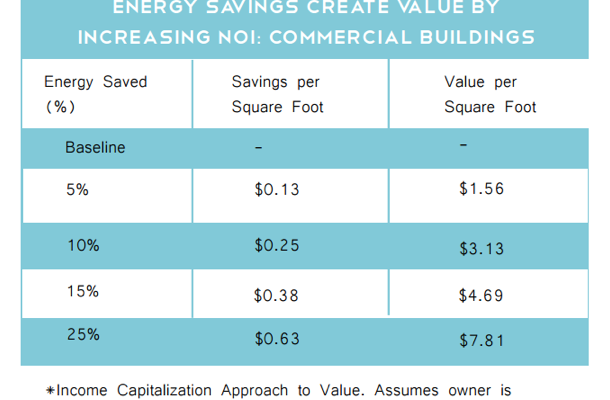

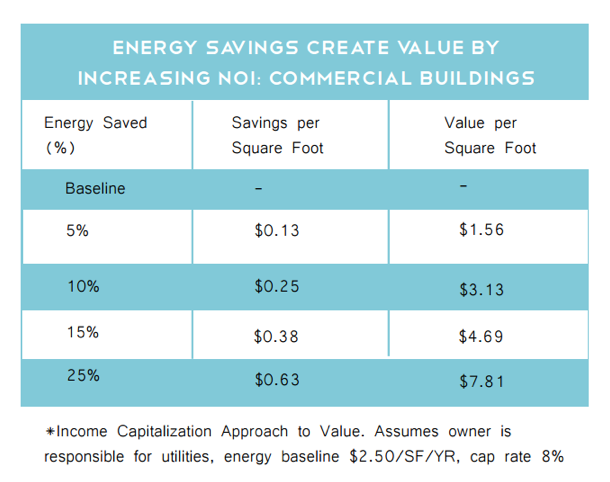

The benefits of energy efficiency don’t stop at the meter—they extend to your bottom line. Improved energy performance can boost your net operating income (NOI) and increase your property’s asset value.

Read on to learn about the many ways in which energy efficiency can give your building a competitive advantage in real estate markets. Then, explore ten steps to help you to maximize the value of efficiency by incorporating upgrades into your capital budget plan with the right approach and timing.

Commercial energy efficiency is directly tied to lower utility bills and, consequently, lower overall operating expenses. There are also a host of non-energy benefits to efficiency. A study by the U.S. Department of Energy found that high-performing buildings are able to demand higher rental rates. They also attract better quality tenants with superior creditworthiness and maintain increased occupancy rates.

Although it may be challenging to quantify, efficient buildings increase tenant comfort, improve occupant health, and allow an owner to market the property as sustainable. The resulting increase in overall rental income, in combination with lower operating expenses, means higher NOI.

This translates to increased asset value and a competitive advantage in commercial real estate markets. Efficiency offers an opportunity for owners and asset managers to invest in repositioning their building and reduce the associated risk of their investment. Appraisers are increasingly adept at including the value of efficiency in their property valuations. This improves an owner’s access to favorable financing and underwriting. Finally, strong energy performance is a reflection of excellent building management and can be a key differentiator for a building or an entire firm in competitive markets.

Some financial metrics are more effective than others in evaluating the true costs and benefits of an energy efficiency project. It’s imperative that efficiency champions communicate efficiency performance metrics in terms that will resonate with tenants and ownership. At the most basic level, this requires translating energy savings from simple kWh or KW to monetary benefits, such as increased rental rates and decreased operating expenses in dollars per square foot.

Source: “Green Building and Property Value.” The Institute for Market Transformation and the Appraisal Institute. Published 2013. http://www.imt.org/resources/detail/green-building-and-property-value

Many of the most common financial metrics, such as simple payback period, internal rate of return (IRR), and return on investment (ROI) in fact do not capture the full benefits of energy efficiency projects. To build the strongest case for your efficiency project, emphasize the following key financial metrics:

- Net Present Value (NPV) takes into account the investor’s discount rate to calculate how much a cash flow from energy savings is worth in today’s dollars, which more accurately reflects the value of efficiency across an efficiency project’s payback horizon

- Savings-to-Investment Ratio (SIR) reflects the present value of cash inflows from a project, relative to the present value of cash outflows, which more accurately reflects your return to investment than similar metrics, such as the internal rate of return (IRR)

Step-by-Step Approach: Energy Efficiency in Capital Budgets

To build the strongest business case for efficiency, you should not only leverage the appropriate financial metrics to assess project impacts, but also present the proposal at the right time and in the context of other planned expenditures.

Follow these ten actionable steps to identify the opportunities to fund efficiency projects and successfully incorporate the project into your capital budget planning.

- Establish your energy baseline by tracking your usage data with the ENERGY STAR® Portfolio Manager benchmarking tools. This will allow you to calculate realistic savings estimates for a given project.

- Re-examine property lease arrangements to understand how the lease structure will affect who pays and who benefits from a specific efficiency project.

- Review how the split incentive barrier may apply within your property

- Find out whether there are existing capital expense recovery clauses to allow owners to pass on project costs to tenants

- Determine who bears the common area maintenance (CAM) costs and how efficiency projects could lower these costs

- Examine operational expense (OPEX) and capital expense (CAPEX) planning processes to understand the project planning and budgeting cycle.

- Acquaint yourself with the appropriate balance sheet and identify existing working capital and available cash flow. Take into account the costs of depreciation.

- Determine internal project requirements, such as expected IRR, ROI, payback period, and the discount rate for a specific project. Determine the external investment factors, such as regional capitalization rates and energy costs.

- Identify utility incentives available to offset upfront costs and factor these in to your financial analysis.

- Complete a comprehensive financial analysis that emphasizes key metrics, such as project Net Present Value (NPV) and Savings-to-Investment Ratio (SIR), and prioritize projects with higher NPV or SIR for implementation.

- Estimate the financial benefits in terms that ownership and tenants understand, such as annual savings ($) and change in rental rate ($/sq ft).

- Explore the financing resources available to finance commercial efficiency projects and incorporate the costs of delaying projects. See our ‘Financing Primer’ for an overview of the following mechanisms, and recommendations to present your proposal to lenders for the best chance of success.

- Determine which financing option is best for you

- Property Assessed Clean Energy (PACE) financing

- Utility on-bill financing and on-bill repayment options

- State loan programs

- Operating and capital leases

- Energy performance contracts (EPCs) through Energy Services Contractors (ESCos)

- Energy services agreements through service providers

- Traditional lenders

- Determine which financing option is best for you

- Take steps to ensure future efficiency project planning is integrated into the annual budgeting process.

- Consider adding a dedicated energy efficiency budget to future capital plans

- Consider creating a revolving loan fund to support future reinvestment in efficiency

- Establish recurring energy planning meetings to review and vet efficiency projects with enough time to incorporate them into the budget properly

These practices and tools, when applied during the appropriate phase of the capital budgeting process, will allow you to create a strong business case for efficiency and position a project for approval and successful implementation.

Market leaders nationwide are applying these principles to real projects.

At the Portrait Building, in Washington, D.C., property managers successfully integrated a series of energy improvement projects into their capital budget plans, bringing value to both tenants and owners. These projects not only added an estimated $1.5 million to the value of the property but also improved its market position by increasing tenant comfort and satisfaction. The success of the Portrait Building project has spurred its ownership and management teams to pursue similar efficiency opportunities throughout their portfolios. Explore the Institute for Market Transformation’s case study on the project to learn how management developed the financial analysis and project forecasts.